Billionaires Michael and Susan Dell have made a landmark $6.25 billion pledge, which is one of the largest private commitments to U.S. children in modern history. This donation will support the rollout of new federal investment accounts for children, providing seed deposits for 25 million children under age 10 who qualify under income-based guidelines. The initiative aims to offer millions of American families an early foothold in long-term financial planning.

The so-called “Trump Accounts”—investment vehicles authorized under President Donald Trump’s One Big Beautiful Bill Act—form the foundation for this initiative. The commitment from the Dells coincides with the launch of these accounts, which combine tax changes and new federal spending programs. The U.S. Department of the Treasury will administer the accounts, while private firms will manage them using low-cost index funds tied to the stock market.

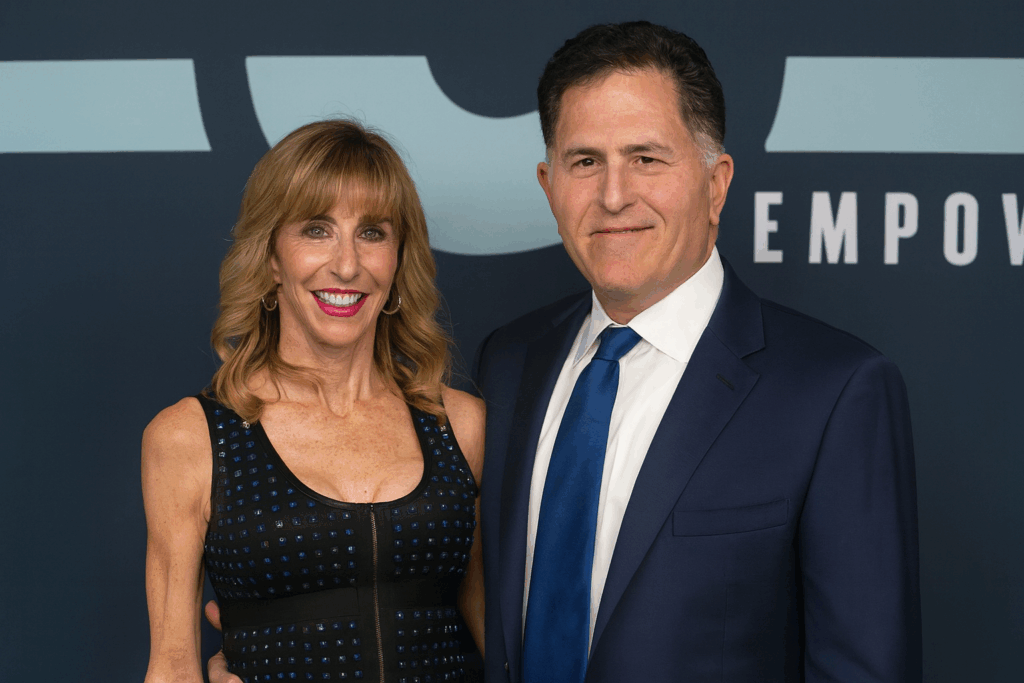

Michael Dell, founder and CEO of Dell Technologies, described the initiative as a generational investment in the nation’s economic future. “We believe that if every child can see a future worth saving for, this program will build something far greater than an account,” Dell said. “It will build hope and opportunity and prosperity for generations to come.” Forbes estimates Dell’s net worth at roughly $148 billion, placing him among the wealthiest Americans.

Eligible children will receive $1,000 federal deposits if born between Jan. 1, 2025, and Dec. 31, 2028, while the Dells’ donation extends the benefit by offering $250 deposits to families whose children fall outside the federal window. The goal, according to the couple, is to ensure that younger children—especially those in ZIP codes with median family incomes below $150,000—are not excluded when the program launches on July 4, 2026.

In interviews promoting the initiative, the Dells said they timed the launch date to coincide with the country’s 250th Independence Day. Families can contribute additional funds over time, and account balances will remain invested until the child turns 18. At that point, withdrawals may be used to pay college tuition, purchase a first home, or start a small business—major life milestones that research shows are heavily influenced by early financial resources.

The initiative comes at a time when child poverty is again climbing, despite its historic scale. In 2024, roughly 13% of U.S. children lived in poverty, according to the Annie E. Casey Foundation. Researchers have linked rising hardship to the erosion of public support, including the expiration of pandemic-era benefits and the absence of universal paid parental leave.

While investment accounts may foster long-term stability, policy experts note they do not directly address families’ immediate hardships. Provisions in the broader bill—including Medicaid eligibility changes, reduced food assistance, and cuts to childcare subsidies—could erode support for low-income households as new investment options expand. These tensions have prompted debate among social policy researchers over whether Trump Accounts alone can reduce structural child poverty.

Philanthropic leaders believe the Dells’ involvement could inspire wider participation. The couple expanded their commitment after seeing the initiative’s potential. Susan Dell emphasized their desire to encourage regular contributions from both families and major donors, expressing excitement about leading in philanthropy and anticipating broader engagement to benefit America’s children.

Michael Dell reinforced these expectations, focusing on the long-term growth potential of widely accessible investment accounts. According to him, even modest family contributions could, through compounding over decades, transform financial opportunities for an entire generation.

Program success will hinge on household participation and continued public and private contributions. Despite this uncertainty, advocates note the Dells’ unprecedented philanthropic backing has already changed the national conversation about the possibilities of early-life investment.