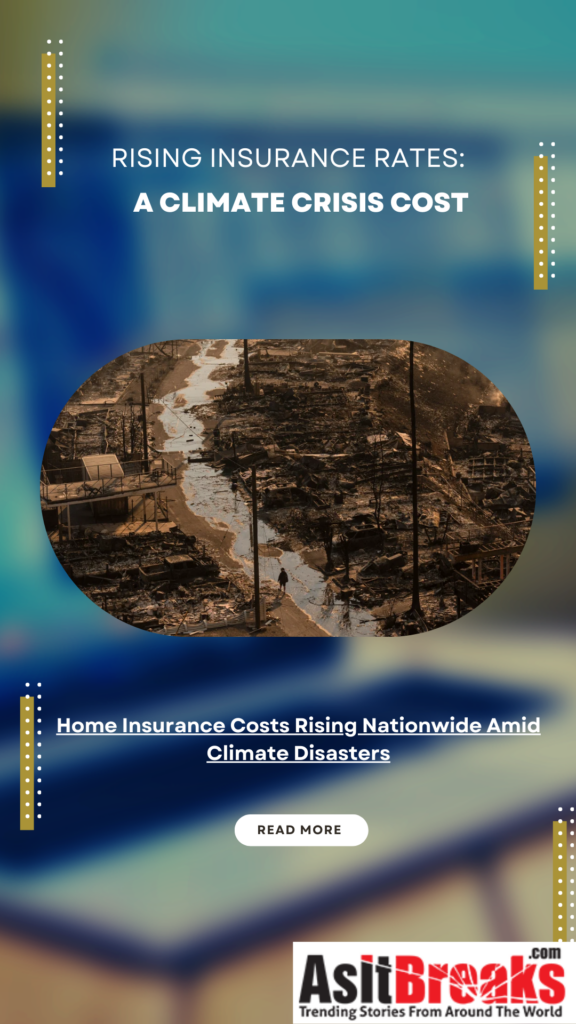

NEW YORK — Homeowners insurance rates across the United States are set to climb as the financial fallout from climate-related disasters like California wildfires and Southeast hurricanes ripples nationwide. Even households far from disaster zones may feel the impact, as insurers adjust premiums to cover escalating costs.

This month’s wildfires in Southern California, estimated to cause $35 billion to $45 billion in insured losses, follow a series of costly events, including last year’s Hurricane Helene and Hurricane Milton. Combined, the two storms added between $54 billion and $78 billion in insured losses, highlighting the increasing toll of extreme weather on the insurance industry.

State regulators are permitting insurance companies to raise premiums not only to cover these localized disasters but also to address rising reinsurance costs—insurance purchased by insurers to mitigate catastrophic risks.

“In a world where we have persistently large shocks, you’re getting big cross-subsidies across the country,” said Ishita Sen, a Harvard Business School professor, referencing a 2022 study linking major disasters to nationwide rate hikes.

Critics argue this system unfairly burdens homeowners far from disaster-prone regions. “In states where regulators apply less scrutiny, insurers are able to charge whatever they want,” said Carmen Balber, executive director of Consumer Watchdog. She advocates for stronger, uniform regulations to curb rising premiums.

Insurers counter that premium increases reflect the broader risks and costs across the U.S., rather than transferring the financial burden of one region to another. “Rates cannot be raised arbitrarily,” said Loretta Worters, spokesperson for the Insurance Information Institute.

Extreme weather events are becoming more frequent and severe, contributing to a rise in homeowners insurance premiums by an average of 8.7% annually between 2018 and 2022, outpacing inflation, according to Treasury Department data.

“Homeowners insurance is where many Americans are now feeling the financial effects of climate costs directly,” said Ethan Zindler, a former Treasury climate counselor.

As climate-related disasters intensify, their economic repercussions are expected to further reshape the insurance landscape, with rising premiums becoming an inevitable cost of global warming.